A new report by business analysts Interact Analysis suggests that the global market for forklifts is considerably greater going forward than was first thought.

Prior to 2019 the global forklift market had been underperforming for a significant period. Things got worse in early 2019 as fears of a recession caused companies to hold back planned investments in new materials handling equipment. By Q4 2019, an uptick in orders was visible, but then the pandemic hit and Q1 2020 saw a drop in orders of nearly 70% year-on-year.

However, as the pandemic drove e-commerce to hitherto unseen levels, there was a sharp rebound in order-intake, especially in China. Like many industries forklift manufacturers then suffered from the problem of being unable to ship large numbers of orders due to supply chain blockages.

Above: as the pandemic drove e-commerce, there was a sharp rise in forklift orders

High growth first half of 2021

The gap between orders and shipments has widened during 2021 owing to the shortage of raw materials (notably steel) and rapid increases in logistics pricing, especially in shipping, which have seen the cost of a single container rising by as much as 500%. On top of that, labor shortages and energy supply problems continue to hold back production. As the graph above shows, 2021 shipment growth is about half that of order growth.

Growth in order intake is being driven by problems caused by enforced social-distancing and staff-absence in factories and warehouses during the pandemic. This, coupled with the growth in e-commerce logistics and large numbers of unfilled vacancies, has accelerated a shift towards automation as companies strive to future-proof their enterprises and make them more flexible to respond to sudden changes in demand.

China has, unsurprisingly, led the market – taking in orders for 590,000 units in the first quarter of 2021. The volume of orders in those first 3 months was equal to the volume in the first 4.5 months in 2020. But in the second half of the year, we`ll see a significant slowing in growth due to the global supply chain problems. Ultimately, overall growth for the year will balance out to around 30%. CAGR between 2021 and 2030 will be 6.1% globally, with worldwide annual sales of forklifts exceeding 3.4 million units by 2030.

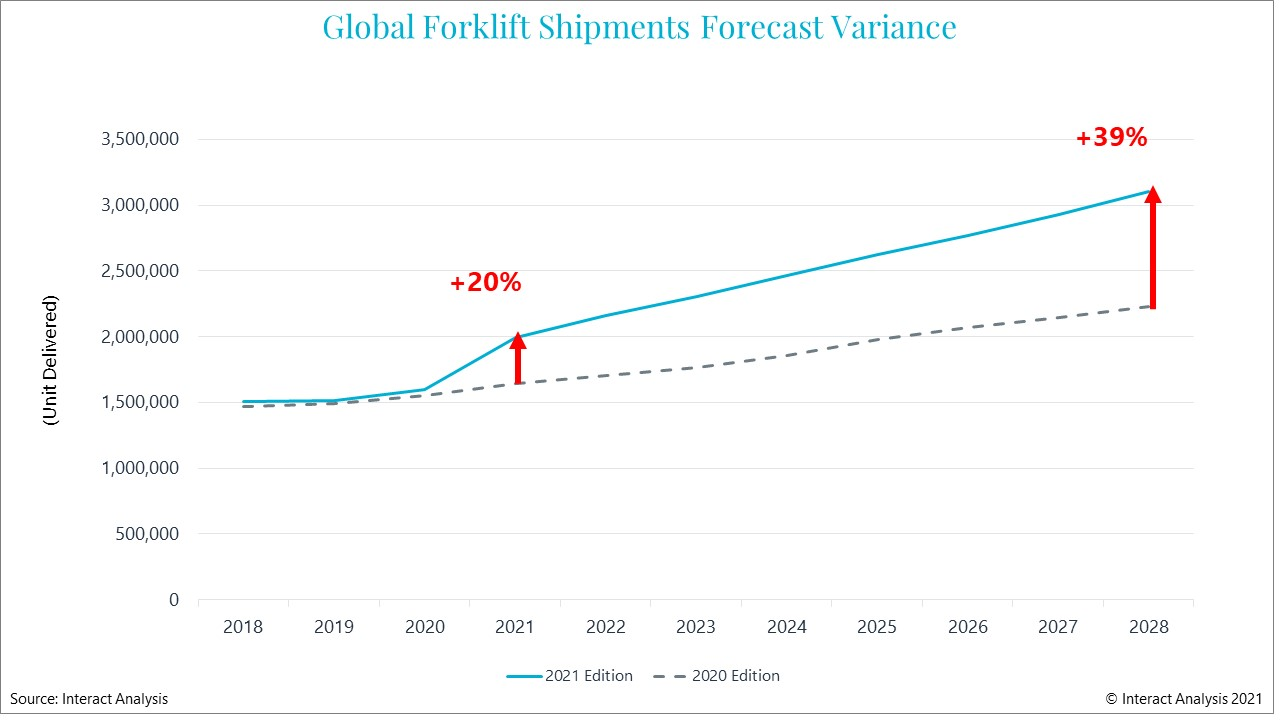

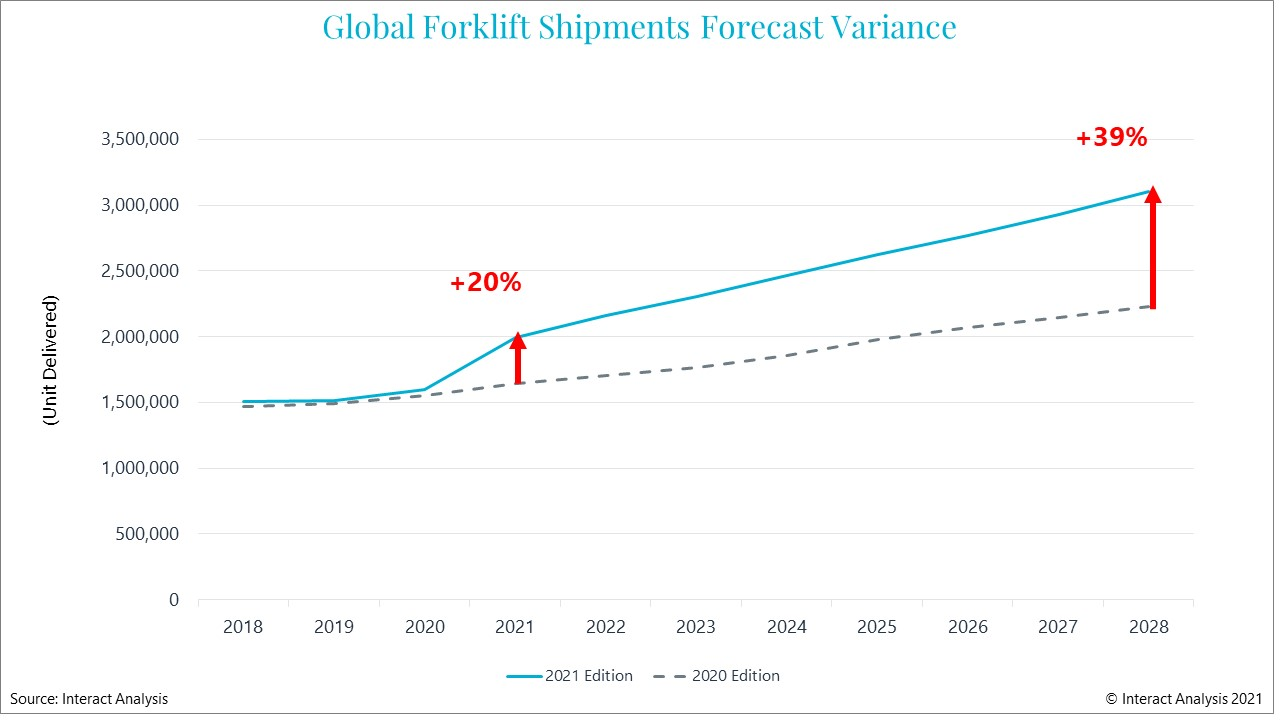

Shipment forecasts for 2028 reveal new spike

In general, our prognosis for the forklift market is much more positive than previously assumed. Our 2021 shipment forecast is 20% higher than our 2020 forecast, while our forecasts for 2028 are 39% higher. To some extent, the sharp rebound in 2021 has raised the growth base across the whole of the next decade. Much of this is due to the increased determination, prevalent in the manufacturing and logistics sectors, to invest in automation solutions as a result of their experiences during the pandemic.